Bitcoin and Ethereum Surge Past $104,000 and $2,400: Analyzing the 2025 Rebound and Market Implications

Estimated reading time: 7 minutes

Key Takeaways

- Bitcoin surpasses $104,000, Ethereum breaks through $2,400 in a historic rally.

- The 2025 rebound is driven by macroeconomic factors, regulatory clarity, and technical catalysts.

- Institutional adoption has significantly increased, impacting market dynamics.

- Investors should be aware of potential risks despite bullish trends.

- The future outlook suggests continued growth but calls for cautious optimism.

Table of Contents

- Key Drivers Behind the 2025 Rally

- Asset Correlation Shifts: “Digital Gold” or Risk Asset?

- Technical Analysis: Resistance Levels and Derivatives Trends

- Institutional Adoption and Regulatory Impact

- Risks to the Rally

- Altcoins and DeFi: Lagging or Leading?

- Future Outlook: Price Predictions and Catalysts

- Conclusion

- Frequently Asked Questions

Key Drivers Behind the 2025 Rally

Macroeconomic Factors

The crypto market’s explosive growth can be attributed to several macroeconomic catalysts:

- U.S. inflation dropping below 3%, prompting dovish central bank policies

- Traditional market underperformance driving investors toward digital assets

- Global economic uncertainty increasing crypto’s appeal as an alternative investment

Regulatory Clarity

The regulatory landscape has significantly improved, boosting institutional confidence:

- Implementation of U.S. stablecoin legislation

- EU’s MiCA framework providing clear operational guidelines

- Enhanced regulatory certainty reducing institutional barriers to entry

Technical Catalysts

Major technical developments have fueled the rally:

- Ethereum’s Pectra upgrade significantly improving scalability

- Record-breaking Bitcoin ETF inflows, with BlackRock’s IBIT attracting over $2B monthly

- Reduced gas fees enhancing network usability

Asset Correlation Shifts: “Digital Gold” or Risk Asset?

The traditional correlation patterns between crypto and other assets have undergone significant changes:

- Bitcoin’s correlation with the Nasdaq has dropped to 0.2 from 0.7 in 2023

- Ethereum shows a strengthening inverse correlation with gold at -0.4

- Cryptocurrency increasingly viewed as a hedge against fiat devaluation

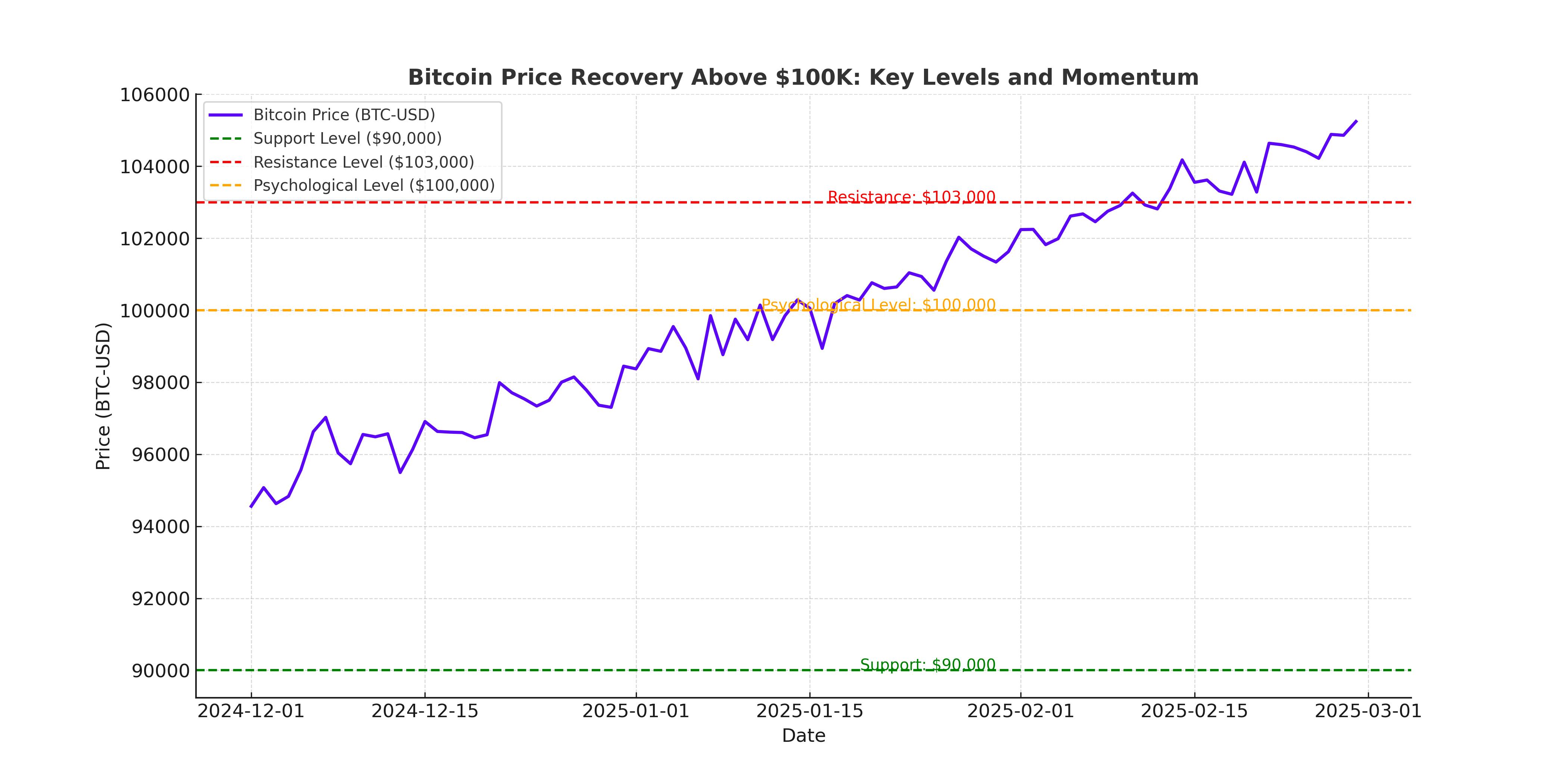

Technical Analysis: Resistance Levels and Derivatives Trends

Bitcoin Technical Analysis

- Current resistance level: $110,000 (inflation-adjusted 2021 ATH)

- Strong support established at $95,000 (50-day EMA)

- Healthy derivatives funding rates at 0.01%

Ethereum Technical Analysis

- Successful breakout above $1,900 resistance

- MACD indicators showing strong upward momentum

- Next major resistance level at $2,600

Institutional Adoption and Regulatory Impact

The institutional landscape has evolved dramatically:

Bitcoin ETF Impact

- Combined ETF holdings exceeding 800,000 BTC

- Total AUM surpassing $80 billion

- Growing institutional FOMO driving further adoption

Regulatory Developments

- Successful implementation of MiCA framework in Europe

- SEC approval of Ethereum staking ETFs

- Enhanced regulatory clarity attracting traditional finance players

Risks to the Rally

Despite the bullish momentum, several risk factors warrant attention:

Geopolitical Risks

- Ongoing Taiwan Strait tensions

- Middle East geopolitical uncertainty

- Potential impact on risk appetite

Market-Specific Risks

- High leverage levels (aggregate open interest exceeding $50B)

- Concerning low spot trading volumes

- Potential regulatory challenges for privacy coins

Altcoins and DeFi: Lagging or Leading?

The broader crypto ecosystem is showing strong performance:

Altcoin Performance

- XRP targeting $2.50 after breaking $1.80

- Layer 2 tokens showing 30% monthly gains

- Strong correlation with Ethereum’s success

DeFi Ecosystem

- Total Value Locked (TVL) reaching $200B

- Aave and Uniswap v4 leading DeFi innovation

- Growing institutional interest in DeFi protocols

Future Outlook: Price Predictions and Catalysts

Short-Term Projections

- Bitcoin poised to test $110,000 resistance

- Ethereum targeting $2,600 by June 2025

Long-Term Outlook

- Ethereum projected to reach $3,700 by EOY 2025

- Continued institutional adoption expected

- Impact of upcoming Ethereum Electra upgrade

Conclusion

The 2025 cryptocurrency rebound represents a perfect storm of positive catalysts, from institutional adoption to technical innovation. Bitcoin and Ethereum’s surge past $104,000 and $2,400 respectively marks a new era in crypto market maturity.

Investors should maintain a balanced approach, monitoring ETF flows, regulatory developments, and technical indicators while remaining mindful of potential risks. As the market continues to evolve, the role of cryptocurrencies in investment portfolios appears increasingly significant.

This historic rally underscores crypto’s transition from a speculative asset to a mainstream investment vehicle, backed by institutional support and enhanced regulatory frameworks. The future outlook remains promising, though cautious optimism and proper risk management remain essential.

Frequently Asked Questions

Q: What are the main factors driving the 2025 crypto rally?

A: The rally is driven by macroeconomic factors like low inflation, improved regulatory clarity, and significant technical developments such as Ethereum’s Pectra upgrade.

Q: How have asset correlations changed in 2025?

A: Bitcoin’s correlation with traditional markets has decreased, while Ethereum shows an inverse correlation with gold, indicating a shift in how cryptocurrencies are perceived.

Q: What risks should investors be aware of?

A: Investors should consider geopolitical risks, high leverage levels, low spot trading volumes, and potential regulatory challenges that could impact the market.

Q: What is the future outlook for Bitcoin and Ethereum?

A: Short-term projections indicate Bitcoin may test $110,000 and Ethereum could reach $2,600 by June 2025, with long-term outlooks being even more optimistic pending market conditions.